Bad credit and too much debt are a vicious circle. Bad credit happens when debt gets out of hand and you have trouble making payments. But it can be tough to get out of debt when you have no money and bad credit.

You’re likely already familiar with the consequences of bad credit – high-interest rates on credit cards, auto and home loans, higher deposits for housing and utilities, and more. Those challenges can lead to even more debt as you try to keep your head above water.

What Is Debt Consolidation?

As a debt consolidation strategy, you can combine multiple debts into a single monthly payment. Having a single account can make it easier to keep track of everything. In addition, if your average interest rate is higher than average because of poor credit or credit card debt, this could help lower your average rate.

Being a Bad Credit Debt Holder:

Many debt consolidation options need you to have good credit, but most people with good credit aren't interested in consolidating their debts. ' Debt consolidation is typically sought out by people with poor credit who are looking for a way out of their financial predicament. You probably not be able to use all of these options to consolidate debt if your credit isn't stellar, but they're all worth a shot.

Ways to Consolidate Debt Despite Bad Credit:

Many options exist for dealing with debt, but each one is tailored to a specific situation. Don't assume that all of them will work for you at the same time. Do your homework and make an educated decision before making a purchase.

You probably not be able to use all of these options to consolidate debt if your credit isn't stellar, but they're all worth a shot.

1. Borrow from a Loved One:

However, if I didn't mention it, I wouldn't be doing my best to do my research. Why am I so unsure? Loans from family members can cause rifts in relationships if they aren't repaid on time. Debt consolidation may be an option for those with a small amount of debt, but only if they have regular income and are able to make their payments. Put the loan agreement and repayment terms in writing, and you'll both feel more secure and be held to your end of the bargain.

Transferring credit card balances:

Debt consolidation is different from just shifting all of your debt to one new card with a 0% APR. Balance transfers are offered by banks to open new accounts. Currently or new clients can pay no interest on transferred funds. The issue is that there is a 3%-5% transfer charge and the 0% interest duration is normally 12-18 months. Forgiveness is not an option.

2. Take Out a Home Equity Loan:

If you have installed equity in your house, the equity can be used as collateral for a home equity loan. Low-interest home equity loans are one of the cheapest ways to deal with debt, and many people use the money to pay off credit card debt. Make sure your income is steady before you take this route because you risk losing your house if you fall behind on payments. (Ouch!) Credit card debt can go into bankruptcy, but home equity loans cannot.

3. Try A Debt Consolidation Program:

Consolidating your debts into an individual monthly payment is the goal of a Debt Consolidation Program (they should be non-profit). As a result, a certified credit counselor works to reduce or eliminate interest charges on your debt. They'll also work with each of your creditors to get you a lower monthly payment. Everyone can benefit from a Debt Consolidation Program because you don't have to have a good credit score to participate. Just focus on making your new monthly payment on time and in full each month. Steps on how to rebuild your credit are included in the Program's curriculum. A win-win situation for all parties involved.

How to Manage Your Debt Consolidation Loan?

Managing the money you've received from a debt consolidation loan is critical. To help you pay off your debt consolidation loan without incurring additional debt, here are a few tips:

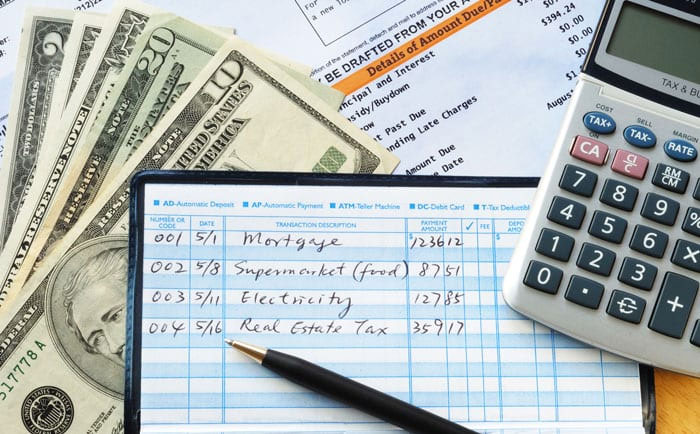

·Create A Budget:

To ensure that you can pay in return the money you've borrowed, write a budget outlining how you'll do so each month. Alternatively, you may want to immediately cut back on some of your current discretionary spendings in order to ensure that you have the funds available each month to repay your loan.

· Pay Off All Debt Immediately:

The first thing you should do with the funds from your debt consolidation loan is pay off everything you owe. Even if they receive the money, some people will divert it to other uses or fail to make good on their debt repayment obligations. You'll only end up in a worse financial situation as a result of this.

·Set Up Automatic Payments:

Consolidation loans often come with the option of auto-pay. Many of them do, and some of them will even give you a discount just for putting it in place. If your bad credit resulted in a high-interest rate, this is a good way to potentially lower your monthly payments. It will also help you stay on the path, which is critical if you want to improve your credit points by making on-time loan payments.